This trailblazing company is ahead of the game in the fastest growing region in the world

It's a strange time to be in mining.

Irrational exuberance has been replaced by irrational despondency.

Just four-five short years ago even the flimsiest prospect or project could look forward to lavish funding and a fat market cap.

Today even those juniors doing the right thing at the right time still cannot attract investors to take it to the next level.

Early stage explorers are being shunned altogether, most investors demand permits in place before taking an interest and even companies with projects near production struggle to attract interest.

I recently visited a small mining firm – Asian Mineral Resources (CVE:ASN) – that ticks all the boxes but suffers the same bear market rating as the quieter corners of the TSX-V, AIM or ASX.

AMR's profile is typical of many juniors:

Listed in Toronto, AMR is run by Aussies with wide-ranging and big-company experience – CEO Evan Spencer is ex-Barrick with stints in Asia and the Middle East, CFO Sean Duffy held senior positions at BHP after tours in Africa, Middle East and Asia. Backing comes from Switzerland and the company's assets is in a frontier market.

What it also shares, unsurprisingly at this moment in mining – a market cap in the lower double digits.

But one thing stands out compared to its peers.

Production, production, production

AMR has cash flow and has been in production for two years.

In 2014 its Ban Phuc mine in Vietnam produced 8,130 tonnes of nickel, 3,780 tonnes copper and small amounts of cobalt as a byproduct.

In its second quarter operational update released last week it upped year on year numbers by 16% for nickel and 14% for copper.

The adit is just about at the vertical midpoint of the mine. Our visit was in the middle of summer – Ban Phuc must be one of very few underground operations in the world that's cooler than outside.

Sales up, costs down

Ni concentrate sold jumped a whopping 32% in the second quarter. Chinese trading giant Jinchuan's enjoys life of mine offtake agreement.

Ban Phuc with a 450ktpa capacity was built for just $34 million and AMR's mill recoveries exceed targets at 86.8% nickel and 93.9% copper.

Combine that with low-cost highly skilled Vietnamese labour (when China outsources to a country to take advantage of cheap workers you know it's real), hydro-power from the grid and it gives Ban Phuc some of the lowest all-in costs in the industry.

In its most recent update AMR slashed costs to $4.55 per pound Ni equivalent.

Attention deficit

Certain sectors – and probably rightfully so – are no-go areas for investors.

Terrible fundamentals put iron ore and coal firmly in that category but the current skittishness extends to minerals with bright outlooks.

AMR's commodity – nickel – is one of the latter with some of strongest market fundamentals among industrial metals.

Of course, the euphoria of a year ago when the ore ban by Indonesia – supplier of a fifth of the global total – pushed prices briefly above $20,000, is gone.

Like bellwether copper, prices remain near multi-year lows after bouncing back from last week's commodity markets panic. But expected sustained and growing deficits starting in 2015 is bound to lift nickel (and copper) prices.

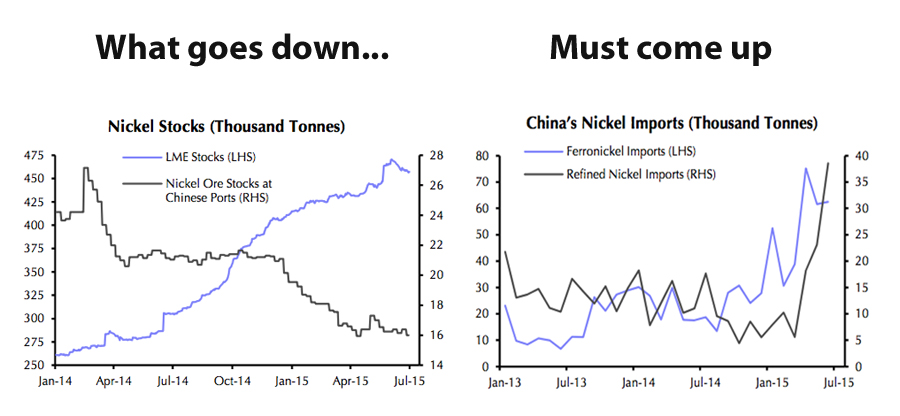

The Indonesian ore ban has seen Chinese stocks reach critical levels.

The move last month by the Shanghai Futures Exchange to accept Norilsk's metal for delivery against contracts caused a dip in the price but is also another sign that the metal is getting very scarce inside the country. In June refined nickel imports rose by a whopping 67% month on month and by 250% year on year.

High and rising LME warehouse stocks have kept a lid on the price, but after many years of growing inventory June was a turning point. Chinese stocks are now at a four-year low and at the same time Chinese pig iron production is set to decline – opening up the market for concentrates.

Source: Capital Economics

Long tail economics

With the tailings dam finished all of Ban Phuc's capital development has been completed. Spencer says this allows for significant demobilization of plant equipment and resources associated with the works, further reducing spend.

This picture doesn't do justice to the sheer size of the spill-over for the Ban Phuc tailings, designed for a once in a century typhoon.

Good morning Vietnam

AMR is the only foreign-owned private company allowed to mine in Vietnam. The South-East Asian nation of 94 million people is on a growth spurt with forecast for GDP expansion of 6.7% this year.

The government of the socialist country which is following a similar development path as China has also been easing business regulations and making structural reforms.

View from the roof of the tallest tower in the country's fast growing capital in the north.

Underlying the boom is an expanding factory base as foreign manufacturers seek a low-cost alternative to China. Authorities in Hanoi are also accelerating the sale and corporatization of state-owned enterprises. As the trail-blazer in private foreign investment in the mining sector AMR is well positioned as reforms are pushed through.

During the second quarter AMR participated in the Sustainable Mining Program held in Hanoi and attended by the Mines, Industry & Technology and Finance Ministries. Another potential game changer for the company is tacking on a smelter of which designs have already been drawn up.

Refining brings down export tariffs from the current 20% for nickel concentrate to 5% for nickel matte, lowers transport costs and boosts process recoveries. Spencer says AMR is in talks about a smelter but it's too soon to make an announcement.

Socialist

According to the latest EY survey getting — and keeping — a social license to operate, as well as resource nationalism, remain among the top five business risks for mining companies.

With a 94% local workforce spread across its management offices in Hanoi and its Ban Phuc mine, AMR appears to have cracked that particular nut.

Spencer, who took the helm at AMR in January last year, is rightfully proud of the company's safety record (801 days and counting) and its promotion of female employment.

Think local, act local

The Ban Phuc is located in the rural, underdeveloped, mostly subsistence farming north-west of the country and the camp sits smack in the middle of the local community.

Apart from spending evenings in the community (do try Vietnamese pork ribs and Ha Noi beer is surprisingly smooth) AMR showed us a number of community projects including alternative employment for women farmers and a suspension bridge built by AMR connecting different parts of the surrounding community.

Every square inch of the country seems to be cultivated and we were shown a rice paddy not far from the mine which increased crop yields after receiving soil from earthworks during Ban Phuc's construction. The company also runs meals, clothing and sanitation programs at local schools.

This is going to be massive

Massive nickel sulphide deposits have similar economics to copper porphyries but discoveries are dwindling.

Most of the world's large-scale advanced-stage projects are from low-grade and therefore high-capital-cost laterite deposits.

Ban Phuc's massive sulphide veins (MSVs) lying in the Song Da rift zone host a number of projects and a producing mine extending into neighbouring China over 200km from Ban Phuc.

The geotectonic setting is similar to major nickel-copper-PGE deposits worked by Norilsk’s and Jinchuan (China’s largest nickel miner). Drilling at Ban Phuc has hit platinum grades of 2-3gpt.

AMR has a 50km2 exploration licence within a 150km2 concession.

Underground diamond drilling focused on a high-priority, high-grade target down dip of the existing MSV orebody started a few days after our party left Ban Phuc.

Offerings brought by locals and placed at the mine entrance to bring good luck and perhaps with it a great high-grade discoveries.

It's come a long way

The Ban Phuc deposit was first identified in 1959 and in 1993 AMR formed a joint venture with the Ministry of Heavy Industry of Vietnam.

The company listed on the Toronto Venture Exchange in 2004 and by 2006 had produced a feasibility study and received a mining license.

But a combination of a hike in concentrate export tariffs by Vietnamese authorities from 5% to 20%, a global slump in the price and a typhoon that hit the mine site located 160km west of the capital Hanoi, scuppered the project.

By 2009 AMR had revived Ban Phuc and in 2012 a cash injection by resources investment firm Pala to take a majority stake created today's AMR.

The river crossing a couple of minutes before you hit Ban Phuc after a five-hour drive from Hanoi.

- [Editor:Juan]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think