[ferro-alloys.com]

Nickel has finally succumbed to the base metals price rout.

It is still the best year-to-date performer among the core six metals traded on the London Metal Exchange (LME).

But at a current $12,400 per tonne, LME three-month metal is, like the rest of the pack, now trading below year-start levels.

The excitement around the potential boost to nickel demand from its use in electric vehicle batteries hasn't been completely dispelled.

But the "electric premium" in the price has been crushed by the broader market concerns about the escalating trade stand-off between the United States and China.

The tensions between nickel's electric future and the metal's current stainless steel reality are all too evident and if anything are going to become more acute the further the price falls.

Reality check

Nickel was on a roll in the first half of this year, up 25 percent in early June, when it was trading above $15,000 per tonne.

Funds were enthused by the narrative of a step-change in usage thanks to nickel's input into the lithium-ion battery technology that is driving the electric vehicle revolution.

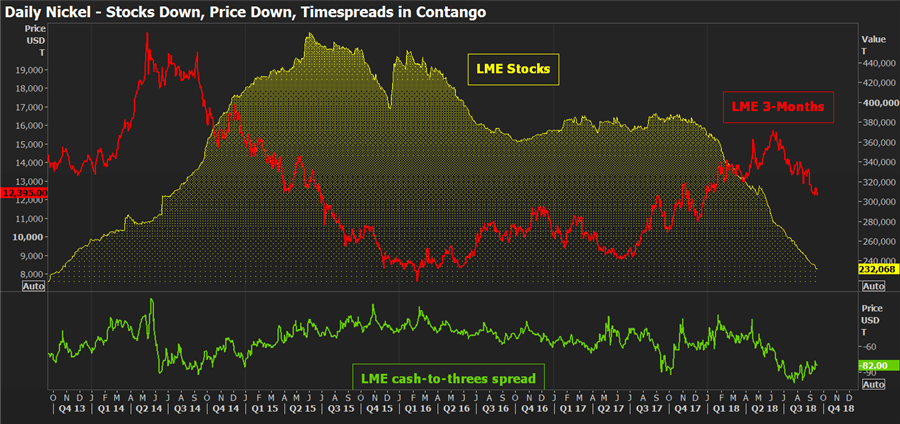

It helped that future expectations were complemented by the bullish reality of fast-falling exchange stocks of nickel.

Inventory is still falling by the day but there is a growing awareness that a good part of what is leaving is simply being relocated as the battery supply chain, which needs the sort of Class I nickel traded on both London and Shanghai markets, pre-emptively builds its own stocks.

Combined exchange stocks have fallen by 162,000 tonnes so far this year, but the International Nickel Study Group estimates the global market registered a smaller supply deficit of 81,000 tonnes in the first six months.

The disconnect becomes more evident over a longer time frame.

Analysts at Wood Mackenzie note that exchange stocks have fallen by 420,000 tonnes since their end-2017 (LME) and mid-2016 (Shanghai Futures Exchange) peaks.

"Over this period there was a cumulative market deficit of only 145,000 tonnes, suggesting 275,000 tonnes has likely transferred into private depots". ("Metals & Mining Snapshot", Sept. 18, 2018)

Certainly, there is no evidence of tightness in time-spreads on the London market.

The benchmark cash-to-three-months spread was valued at a super-relaxed contango of $82 per tonne at Monday's evaluations.

What Woodmac describes as a "greater understanding of this stock movement" was weakening nickel's bull narrative even prior to the latest escalation of the U.S.- China trade war.

Stainless target

The current reality of nickel's usage profile is that the amount of metal heading to the battery sector is still dwarfed by the tonnage used in making stainless steel.

And the stainless-steel sector, which has been booming, looks potentially vulnerable to any tariff-induced slowdown in manufacturing activity, particularly in China, the world's largest producer.

It doesn't help that the stainless sector is itself being disrupted right now by the ramp-up of Tsingshan's three-million-tonne facility in Indonesia.

The Chinese producer's offshoring of new capacity has already led to China opening an anti-dumping investigation into its exports back into the mainland market.

"The export of this low-cost stainless to China has weighed on price and driven cuts, particularly of high-nickel 300 series," according to analysts at Morgan Stanley ("Nickel – back to normal", Sept. 10).

Both Morgan Stanley and Woodmac note Tsingshan has started redirecting shipments to other Asian countries and Europe.

This will alleviate some of the pressure on Chinese stainless mills but will increase pricing pressure on everyone else.

The Indonesian disruption to the stainless supply chain is set to continue with another Chinese operator, Delong Holdings , preparing to launch another two million tonnes of capacity in the country, according to Morgan Stanley.

This backdrop of oversupply in the stainless sector left it, and by extension nickel, particularly vulnerable to fears of a hit on demand resulting from trade tariffs.

Pricing tensions

None of which negates the bull argument that nickel is going to get an incremental boost over time from its use in electric vehicles.

Not least because battery manufacturers are actively seeking to increase the amount of nickel relative to more expensive cobalt.

This tension between nickel as stainless input and nickel as battery input has been simmering for some time.

It is likely to become ever starker, the further the price falls.

Electric dreams have caused something of a global nickel rush as existing producers dust down expansion plans and new entrants try to grab a slice of the expected future action.

In Indonesia Sumitomo Metal Mining and Vale are cooperating on a new 40,000 tonnes per year facility to generate an intermediate product that could be used to make battery-grade nickel sulphate. Tsingshan is looking to branch out from stainless into the battery sector.

In Australia U.S.-based private equity firm Black Mountain is set to buy the Lanfranchi mine, which last produced in November 2015.

Its previous owner Panoramic Resources placed Lanfranchi on to care and maintenance at a time when the nickel price was sliding below $10,000 per tonne.

The price has recovered since then but it's now also a long way off the June highs above $15,000 with the potential for further contagion from the risk-off mood pervading the industrial metals complex.

Morgan Stanley argues that prices are unlikely to revisit the 2015-2016 lows precisely because of curtailments such as Lanfranchi.

But the bank continues "to see the need for a nickel price above $16,500 per tonne in the longer term, to incentivise new mine supply to feed both the stainless and electric vehicle sides of the market."

The problem is that one price may not fit both stainless and electric requirements.

What the nickel market really needs is two prices, one specifically for battery-useable nickel sulphate.

The LME is actively considering such a product but until it exists, nickel's battery-stainless pricing tensions will persist.

- [Editor:王可]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think