[Steel tender] The progress of steel bidding of June was moving a little bit slow. The published price of steel bidding was mostly between 5900-6100 yuan per ton, and the average price rose over 200 yuan per ton on a month on month basis.

[Ferrosilicon exports] According to the latest statistics of the China Customs, in April 2020, China's export of ferrosilicon (silicon content > 55%) was 41104.58 tons, down 7.465% on a month on month basis, an increase of 11.789% on a year-on-year basis; from January to April, export of ferrosilicon (silicon content > 55%) was 116915.5 tons, down 24.81% on a year-on-year basis (the export volume was 155492.1 tons in Jan-Apr in 2019). From January to April, 7400.275 tons of ferrosilicon (< 55%) was exported, down 38.12% year on year. Currently, in the circumstances of overseas epidemic spread and economic weakness in April, the export volume of ferrosilicon, although down from March, exceeded the expectations of many insiders.

[Spot market] Under the influence of joint production resumption of enterprises and gradual recovery of downstream demand, the ferrosilicon market rose steadily in this month, the manufacturers' spot goods were tight, and the quotation continued to rise slightly. In the last week of May, 72# ferrosilicon quotations of large northwest factories had risen to 5600 yuan per ton. Traders expressed that it was difficult to purchase, and market confidence was boosted. Many enterprises have started the plan of resuming production and opening furnaces.

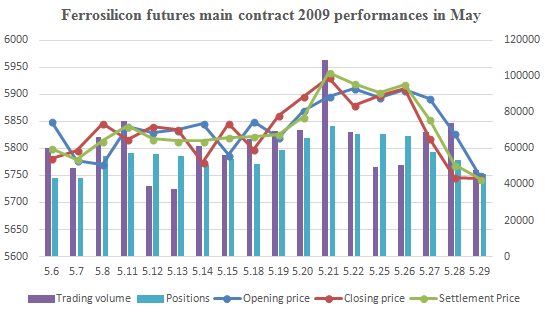

[Ferrosilicon Futures 2005 contract] Opening price of ferrosilicon futures 2005 contract of April was 5850, highest price was 5992, lowest price was 5726, closing price was 5744 and the settlement price was 5744. The positions were 45518 and the trading volumes were 1118472.

[Steel market] During the week of May 28, the weekly output of screw thread steel continued to reach a new high of 3.94 million tons; since April and May, the downstream demand has gradually increased, but from the perspective of weather, there will be 29 days of rain forecast in Guangzhou in the next 40 days, 13 days of rain forecast in Shanghai in the next 40 days, and the frequency of rain will further increase after the middle of June, and the terminal demand for steel is expected to gradually decrease. On the other hand, the recent low iron ore supply and the development of the epidemic situation in South America have increased the uncertainty of iron ore supply in Brazil. Continue to pay attention to the actual supply and demand situation and the change of international epidemic situation.

[Metal Magnesium market] The current cash quotation including tax of 99.9% magnesium ingots in fugu area was around 13300 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think