On Monday, there was news that some major ferrosilicon plants in Ningxia would shut down and it was estimated that the monthly output would decrease 26600 tons. At present, the spot supply side of ferrosilicon is still tight; the ex-factory quotation of semi-coke rose slightly; futures markets hovered at a high level; In August, the steel bidding was launched one after another, and the price increased compared with July. The 75B ferrosilicon bidding volume of HBIS Group in August was 3100 tons, an increase of 1040 tons compared with July. All kinds of advantages as well as domestic and foreign demands are on the support, it is expected that the ferrosilicon market will still operate at a high level in the short term, which makes the price easy to rise but difficult to fall.

In terms of downstream demand, according to the latest data of CISA, the average daily crude steel output of key steel enterprises in late July was 2.1065 million tons, a month on month decrease of 87200 tons, a year-on-year decrease of 3.03%; By the end of late July, the steel inventory of key enterprises was 13.8136 million tons, a decrease of 1.1041 million tons or 7.40% over the previous ten days.

Since this week, most domestic steel prices have risen, but the downstream demand has not recovered, and the transaction performance is general; In July, under the influence of high temperature and rainy weather and maintenance of some factories, the output decreased, and it is expected that the output may rise in August; Ferro-alloys.com will pay close attention to the specific impact of the policy of reducing crude steel output in many places.

In the first week of August, the domestic metal magnesium market maintained stable operation at a high level. Due to the maintenance of some factories in summer, the increase of downstream orders and the high raw material price supported the magnesium price. Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was more than 21000-21100 yuan per ton.

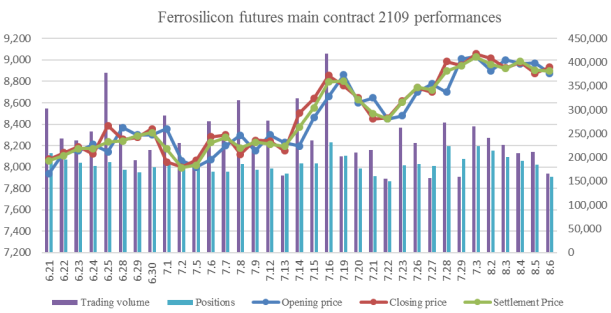

Opening price of ferrosilicon futures 2109 contract of this week was 8900, highest price was 9076, lowest price was 8804, closing price was 8934 and the settlement price was 8898. The trading volumes were 1054057 and the positions were 159574.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think