[Ferrosilicon Market] Since January, Ningxia, Shaanxi, Gansu and other major production areas have put into operation of new submerged arc furnaces, and the next new production is expected to increase, and the operating rate and output of ferrosilicon production end showed an upward trend; On the downstream side, the 75B ferrosilicon tender volume of representative steel mills from January to February was 3396 tons, an increase of 2998 tons compared with December 2021, which injected confidence into the market to a certain extent. The release of winter-storage demand also brought corresponding positive support to the ferrosilicon industry; In terms of raw materials, the notice on rectification of semi-coke and related industries in Yulin and the notice on price increase of Shenmu Lantan Group Co., Ltd. led to the rapid rise of futures for a time, which greatly boosted market confidence. Many ferrosilicon factories said that they had no shipping pressure, and the quotation was firm and rose slightly (some manufacturers suspended external quotation). Although the Spring Festival is approaching and the market turnover is weakening, many people in the industry are optimistic about the market trend after the festival (especially after March). They mostly expected that the supply side would return to a high level and at the same time, the demand would also be greatly improved, and the alloy market was still promising.

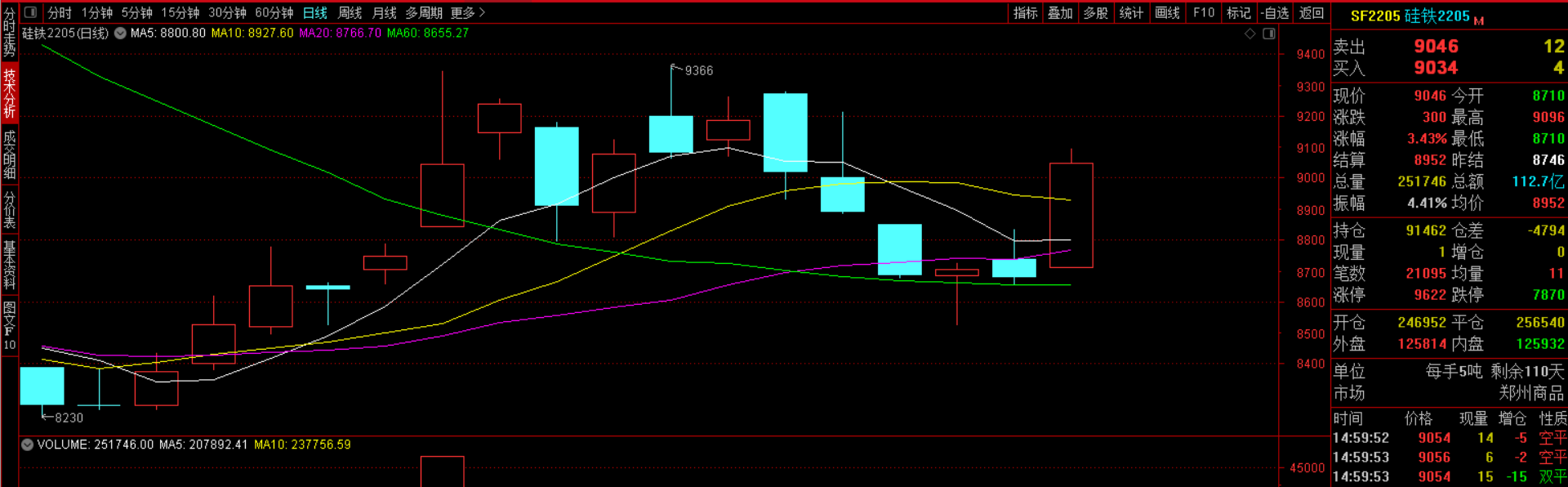

[Futures Market] The opening price of 2205 main contract of ferrosilicon futures in January was 8386, the highest price was 9366, the lowest price was 8230, the closing price was 9046, the settlement price was 8952, the trading volume was 4299700, and the position was 91462, an increase of 7.84%.

[Ferrosilicon Exports] According to data of China Customs, in 2021, China exported 525056.355 tons of ferrosilicon (containing by weight more than 55% of silicon), up by 104.14% year on year; the exports of ferrosilicon (containing by weight ≤ 55% of silicon) was 21655.905 tons, an increase of 12.62% year-on-year. And it’s expected of the oversea market to be positive in 2022.

[Steel Market] The impact of the "carbon peak carbon neutralization " policy on the supply side of crude steel will still exist in 2022, but the intensity may be mitigated; The downstream demand for steel is likely to be repaired in stages compared with that in 2021. With the improvement of production enthusiasm, there will be a risk of decline in the profits of steel mills and steel prices in late 2022. However, considering the level of economic development and relevant policy support, the demand in the first quarter is not expected to be too poor and the market sentiment is optimistic. Since January, the domestic steel market has fluctuated in a narrow range and strengthened steadily. The winter storage policy of steel mills has basically been implemented, and the performance was higher than expected. However, as the Spring Festival approaches, the downstream demand was gradually declining, and the accumulation of inventory was gradually accelerating; At the same time, steel mills in many places were scheduled to stop production for maintenance during the Spring Festival, the output has also declined, the supply and demand have both decreased, and the steel market would be stable in the short term.

[Magnesium Market] Recently, it was common for the domestic metal magnesium market to rise and fall under the game between supply and demand. At the beginning of January, the mainstream ex-factory quotation of magnesium ingots in fugu area was about 51000-52000 yuan per ton. Although the inventory pressure and capital pressure at the factory end were not large, the downstream procurement was more cautious. Soon, the price of magnesium began to fall at an unexpected rate; However, with the continuous decline of prices, the transactions increased. Under the condition that the mentality of upstream and downstream was relatively cautious, the price of metal magnesium maintains the trend of consolidation and shock. At the end of the month, the ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was about 41000-42000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think