This week, ferrosilicon futures fell first and then consolidated, returning to a rational range; The price of raw material semi-coke decreased slightly with the decline of coal price; The demand of downstream metal magnesium for 75# ferrosilicon was fine, while the demand of steel mills was weak because most of them have completed the procurement this month, and the actual transaction was not that satisfactory. However, there were few ferrosilicon manufacturers in stock, the inventory pressure was small, and the export market situation was good, the supply was tight, the price rose, the manufacturers had a strong attitude of stabilizing the price and low willingness to ship at a low price. Although the ex-factory quotation of 72# ferrosilicon was slightly lower than that of last week, it was not large, Market sentiment was mostly cautious. Focus on the changes of supply and demand, the trend of futures market and the progress of policy news.

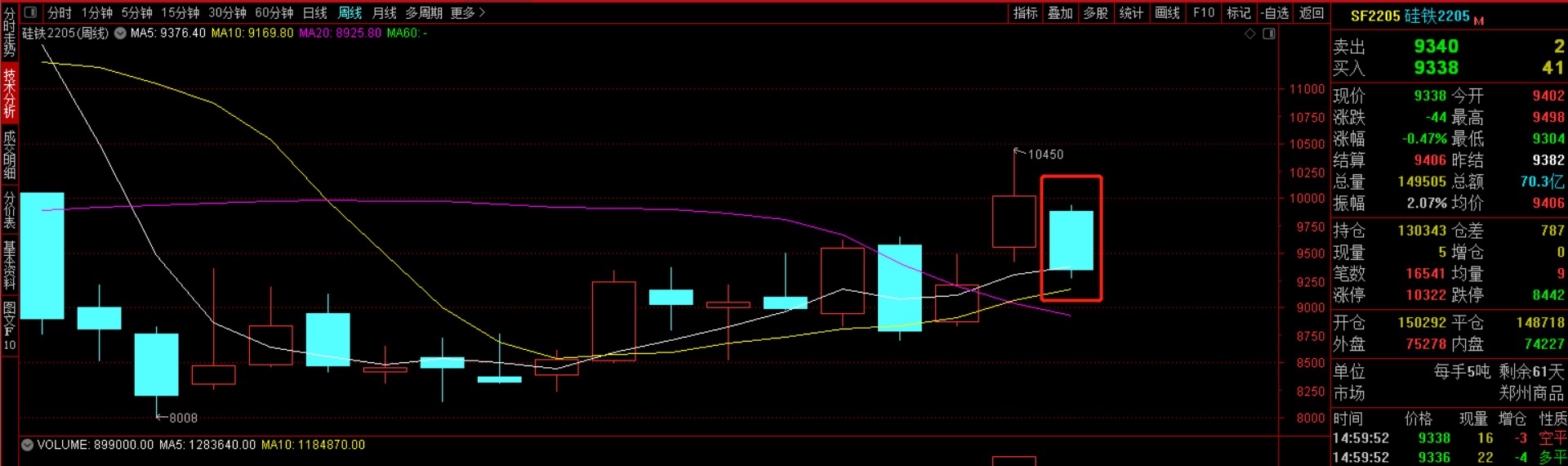

This week, the opening price of 2205 main contract was 9,880, the highest price was 9,934, the lowest price was 9,260, the closing price was 9,338, the settlement price was 9,406, the trading volume was 899,014, and the position was 130,343, a decrease of 6.32%.

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

3.14 |

9880 |

9934 |

9670 |

9714 |

9800 |

191800 |

129989 |

-2.55% |

|

3.15 |

9712 |

9748 |

9270 |

9320 |

9428 |

228557 |

127302 |

-4.90% |

|

3.16 |

9458 |

9596 |

9338 |

9452 |

9474 |

178636 |

125791 |

0.25% |

|

3.17 |

9452 |

9532 |

9260 |

9334 |

9382 |

150516 |

129556 |

-1.48% |

|

3.18 |

9402 |

9498 |

9304 |

9338 |

9406 |

149505 |

130343 |

-0.47% |

In the downstream, the domestic steel market was first pessimistic and then raised this week. Due to the strengthening of local prevention and control, the transportation was blocked and the construction progress slowed down, the actual trading volume of steel decreased in the first half of the week. Although it rebounded in the second half of the week, the current downstream demand was weak after all, and it was difficult to change the weak situation of the steel market in the short term.

This week, the domestic magnesium market decreased first and then stabilized, and the downstream procurement was mainly based on demand. In the absence of demand support, the short-term magnesium market was difficult to change, but the factory's willingness to low the price was not strong. In the game between the two sides, the short-term magnesium Market would still in a station of consolidation. On Friday, the ex-factory cash quotation including tax of 99.9% magnesium ingots in Fugu area was about 40000-41000 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think