At the beginning of this week, due to the large and continuous downward of Futures, the ferrosilicon spot price was slightly loosened under pressure, and the market was weak; On Thursday, the Futures rebounded, and the market sentiment eased to some extent, leading to a small upward in spot prices. At present, the production was stable, the operating rate was relatively high, but the terminal demand was weak, the downstream procurement was insufficient, the enthusiasm for tender of steel plants was low (a small number of steel plants have announced at the moment, the price was about 8500 CNY/T, a month on month decrease of about 100 CNY/T), the inquiries and transactions were few, the supply and demand pattern was not very good, the market was lack of news stimulation, and the market was slightly depressed. Near the end of the month, the steel tender was coming in December. As the last round of steel tender this year, the manufacturers paid more attention to it. They were not willing to deal at low prices. The game between the supplier and the demander was strong, waiting for the tender price of the representative steel plant. It was expected that the short-term ferrosilicon market would continue to operate stably, focusing on supply and demand performance and Futures trend.

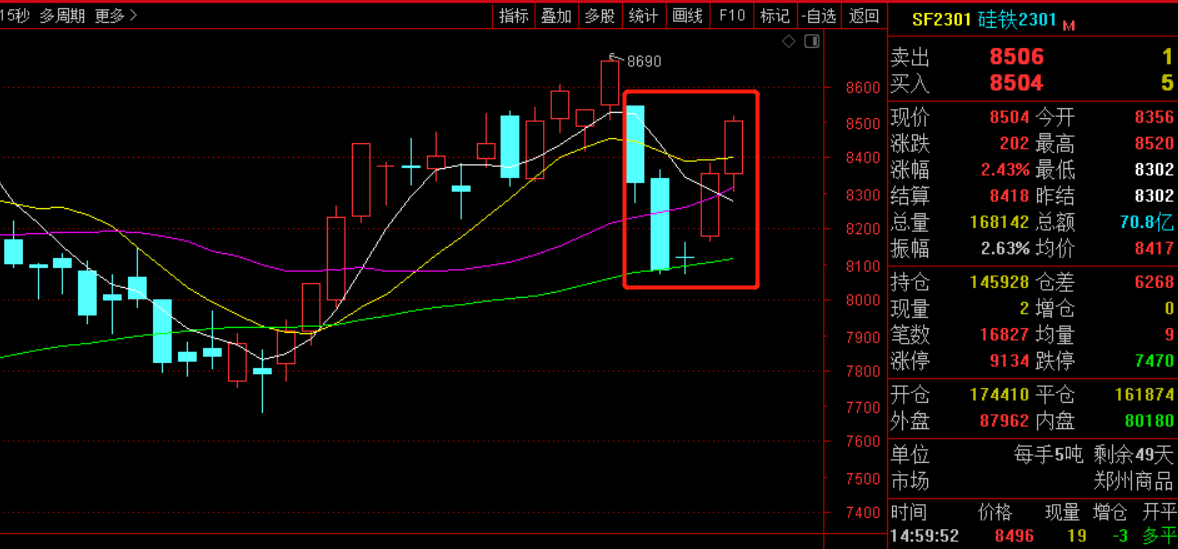

This week, the price of Ferrosilicon Futures declined first and then rose. The opening price of 2301 main contract was 8,546, the highest price was 8,546, the lowest price was 8,070, the closing price was 8,504, the settlement price was 8,418, the trading volume was 1,127,212, and the position was 145,928, down 1.25%.

Below are Ferrosilicon Futures main contract daily specific performances:

|

Date |

Opening price |

Highest price |

Lowest price |

Closing price |

Settlement price |

Trading volume |

Positions |

Range |

|

11.21 |

8546 |

8546 |

8270 |

8326 |

8378 |

275042 |

161052 |

-3.32% |

|

11.22 |

8342 |

8366 |

8070 |

8080 |

8180 |

275596 |

147191 |

-3.56% |

|

11.23 |

8120 |

8160 |

8070 |

8116 |

8112 |

185245 |

139790 |

-0.78% |

|

11.24 |

8180 |

8386 |

8162 |

8356 |

8302 |

223187 |

139660 |

3.01% |

|

11.25 |

8356 |

8520 |

8302 |

8504 |

8418 |

168142 |

145928 |

2.43% |

On the downstream side, according to the data of China Iron & Steel Association, in the middle of November 2022, the key iron and steel enterprises produced 20.0197 million tons of crude steel, with a daily output of 2.002 million tons, an increase of 0.76% month on month; The steel inventory of key iron and steel enterprises was 17.301 million tons, an increase of 578300 tons or 3.46% over the previous decade; An increase of 826700 tons or 5.02% over the end of last month; 418300 tons or 2.36% less than the same ten day of last month; In the middle of November, the social stock of five major varieties of steel in 21 cities was 7.51 million tons, a month on month decrease of 300000 tons, or 3.8%. The stock continued to decline, with a narrow decline. At present, the demand side performance remained weak. In addition, the transportation was blocked, the overall trading was not smooth, the actual shipment situation was less than expected, the spot price was easy to fall but difficult to rise, and the mood was pessimistic and cautious, mostly wait-and-see. However, it was understood that the current inventory pressure was not great, so the willingness to hold the price was strong, and the quotation was mainly stable. In the short term, we still need to continue to pay attention to the actual demand performance.

Affected by the slow release of downstream demand, the transaction performance was under-performing. This week, the magnesium market continued to operate under pressure, with the price dropping about 500-600 CNY/T compared with last week. On Friday, the mainstream ex-factory cash quotation including tax of 99.9% magnesium ingots was about 23000 CNY/T. Under the market pattern of oversupply, it was hard to be optimistic about the magnesium market in the short term. However, at present, the profits of the factories were weak and even there was a loss, it was expected that further decline would be limited. Focus on demand follow-up.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think