U.S. utilities are importing more coal from countries like Colombia, Russia and Indonesia in 2014 to hedge against poor railroad service, fulfill unique blends and, in an alarming trend for Central Appalachia coal producers, because it is less expensive than burning domestic coal.

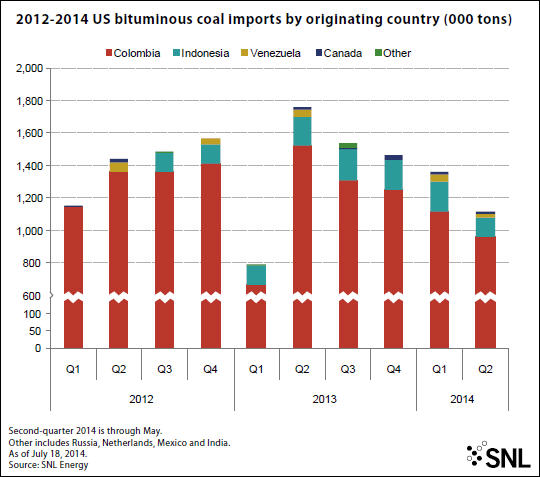

The U.S. imported 1.23 million tonnes of bituminous coal in the first quarter, according to SNL Energy data sourced from the U.S. Department of Commerce, Bureau of the Census, up 73.1% compared to the year-ago quarter. April and May coal imports also topped totals from a year ago.

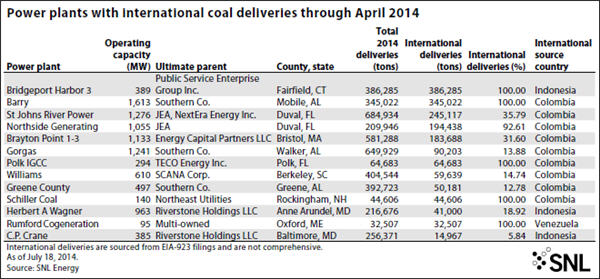

Southern Co. increased its purchases of Colombian coal by nearly 500,000 tons in the first half of the year, a spokeswoman for the utility said. According to SNL Energy fuel delivery data through April, the utility purchased Colombian coal for subsidiary Alabama Power Co.'s Barry, Gorgas and Greene County coal-fired plants. The Greene County plant is co-owned by Southern subsidiary Mississippi Power Co. Most of the Colombian coal is purchased from Drummond International LLC, a unit of Alabama-based Drummond Co. Inc.

"The primary driver for the increased purchase of Colombian coal was in order to provide the most cost-effective fuel for our customers," the Southern spokeswoman said, noting that Southern purchased more than 12 million tons of spot coal in the first half of 2014.

As recently as 2010, it was not uncommon for the U.S. to import more than 1 million tonnes of coal per month. But natural gas prices dropped, coal demand declined and fewer domestic utilities sourced coal from the international market. In 2010, the U.S. imported 12.63 million tonnes of bituminous coal. Three years later, that number fell to 5.04 million.

But coal imports are on the rise again. UBS Securities LLC analyst Kuni Chen noted that the amount of imported coal in 2014 is up off a small base in 2013, triggering what he called "kind of shocking" percentage increases. Still, the increase is evidence of unreliable rail service and weak Atlantic Basin coal prices, Chen said in a phone interview.

The rail issues date back to late 2013, when the confluence of a cold winter and network growth among several commodities significantly hindered velocity on the rails. Peabody Energy Corp. Chairman and CEO Gregory Boyce said July 22 that southern Powder River Basin coal shipments alone declined an estimated 15 million tons during the first half due to poor rail performance. Both Western railroad BNSF Railway Co. and Eastern carrier CSX Corp. have recently acknowledgedcontinued struggles with rail service.

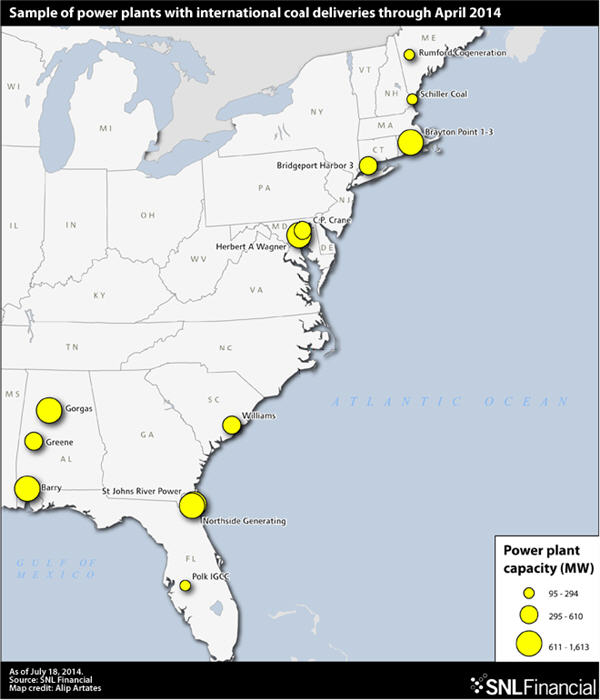

"Colombia coal is low on the cost curve and the transport of Colombia coal to the Southeast U.S., for instance, is not particularly high," Chen said. "That coal is competitively priced against Central App. My understanding is that those imports are used by utilities that are right on the water, so there's no transport inland once it gets to the dock. So, a niche group of utilities can take advantage of that type of coal. There are probably some rail service issues playing a role there, as well."

Indeed, the majority of utilities taking imported coal are on the coast. Robert Peek, the director and general manager of business development at the Jacksonville Port Authority, known as JAXPORT, said in a phone interview that Jacksonville, Fla., utility JEA, for example, operates its own small coal import terminal. JEA has long purchased coal from Colombia.

Another Florida utility, Lakeland Electric, has said Colombian coal, even after the transportation costs associated with shipping the coal to Tampa and trucking it to the plant, is less expensive than purchasing Central Appalachian coal. Mining costs in Colombia are typically low, helping bring down the price.

For Central Appalachia, the influx of imported coal is the latest blow to an already reeling region. Thermal coal producers in the basin are losing market share to the Illinois Basin and metallurgical coal producers are enduring a depressed global market. But Chen said he does not expect Colombian coal to completely supplant Central Appalachian coal in the boilers of U.S. coal-fired power plants, despite the rising cost to produce Central Appalachian coal and rail transportation expenses.

"Colombian coal is competitive against Central App, but it's still a small piece," he said. "It's not going to be 20 or 30 million tons any time soon."

Utilities also taking Russian, Indonesian coal

Colombia is not the only country exporting coal to the U.S. Public Service Enterprise Group Inc.'s Bridgeport Harbor 3 coal-fired power plant in Connecticut, which is owned and operated by PSEG Power Connecticut, took 386,285 tons of Indonesian coal through April, according to SNL Energy data.

In an email, PSEG spokeswoman Melissa Ficuciello said the utility imports Adaro Energy coal due to its ultra-low sulfur content, and it is actually more expensive than U.S. coal.

"Bridgeport Harbor Station Unit 3 in Connecticut switched to this ultra-low-sulfur/nitrogen/ash Indonesian coal back in 2002 and, as a result, is among the cleanest in the Northeast and the nation," Ficuciello said. "We control emissions by limiting the amount of sulfur in the coal, rather than by adding technology on the back end. Due to the low amount of sulfur content in the fuel, the coal unit does not require a scrubber to meet emission limits for SOx."

The Rumford Cogeneration plant in Maine, operated by NewPage Corp., took 32,507 tons of Venezuelan coal through April, accounting for all of its international deliveries.

The Schiller Coal coal-fired plant in New Hampshire, owned and operated by Public Service Co. of New Hampshire, took Colombian coal in April, according to SNL Energy data. PSNH is a subsidiary of Northeast Utilities. The plant also took Russian coal in May, according to Bloomberg, citing a recent bill of lading showing a 38,500-tonne delivery.

In a phone interview, PSNH spokesman Martin Murray acknowledged that the utility also took Russian coal, which is typically lower in sulfur, in 2013. According to SNL Energy data, the U.S. imported 33,017 tonnes of Russian coal a year ago.

"What drives our purchases is meeting our objectives: producing the energy we need, doing it as economically as possible and bettering any kind of environmental requirements we have," he said. "What's unique about our facility is that we are on the seacoast, we have a deepwater port and we have the ability to tap a global market for supplies. We're always looking for sources to meet our objectives."

Murray said the utility experimented with PRB coal several years ago, but it was not suitable for Schiller's boilers. The plant took coal from CONSOL Energy Inc.'s Bailey mine and Alpha Natural Resources Inc.'s Pocahontas mine in 2013, according to SNL Energy data.

U.S.-Russia relations are strained, with the U.S. imposing sanctions on some Russian companies and individuals. Murray said there are no sanctions on exports or imports of coal and that he does not foresee an immediate issue if the U.S. elects to add sanctions on coal.

"The supply we have on hand at this time is going to be able to supply our needs for the rest of the summer and fall and much of the upcoming winter," he said. "We're in good shape in terms of supply."

- [Editor:Yueleilei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think