The moves in spot markets were minuscule on Wednesday, and that form continued in futures trade overnight. It’s eerily quiet, at least compared to usual standards.

According to Metal Bulletin, the spot price for benchmark 62% fines fell 0.3% to $62.24 a tonne, extending the sequence of moving in the opposite direction from the day before to five.

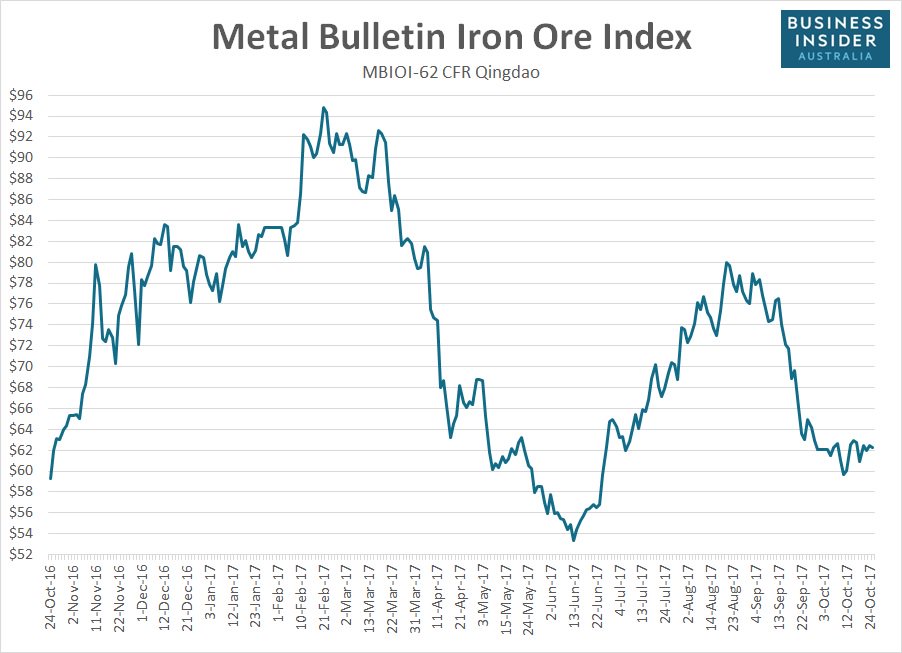

The daily chart below tells the story.

There was a little more excitement across lower grades with the price for 58% fines falling 1% to $36.33 a tonne.

Higher grades were largely unmoved for the session with ore with 65% Fe content easing 0.2% to $83.40 a tonne.

The small moves in spot markets mirrored the price action in Chinese rebar and iron ore futures during the session.

The January 2018 rebar contract in Shanghai closed down 0.72% at 3,703 yuan. Iron ore futures in Dalian also softened, sliding 1.09% to 455 yuan.

That form continued in overnight trade with rebar and iron ore futures finishing Wednesday’s night session at 3,667 yuan and 453.5 yuan respectively.

Although lower, the moves are not large enough to provide a reliable guide as to what direction spot markets will head on Thursday.

Trade in Chinese commodity futures will resume at midday AEST.

- [Editor:Wang Linyan]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think