[Ferro-Alloys.com] Thor Mining has completed the acquisition of American Vanadium, which holds interests in uranium and vanadium projects in Colorado and Utah.

This follows the completion of due diligence work including field sampling that returned up to 1.25 per cent uranium and 3.47 per cent vanadium from 13 outstanding samples that were deemed too radioactive for the original laboratory.

Thor Mining (ASX:THR) executive chairman Mick Billing says that with the acquisition of American Vanadium and its high-grade uranium and vanadium claims, the company now has a well balanced portfolio of very attractive assets.

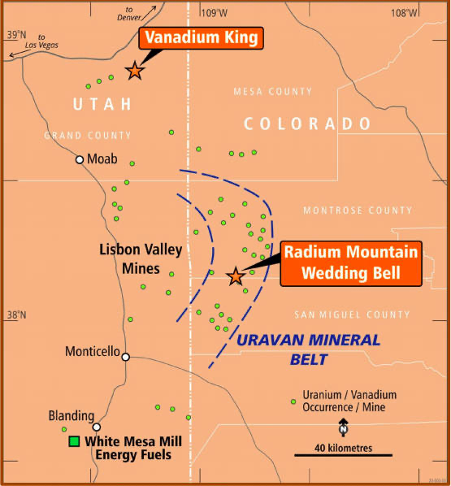

American Vanadium owns 199 contiguous claims (the Wedding Bell and Radium Mountain projects) in the famed Uravan Mineral Belt in southwestern Colorado and 100 claims (Vanadium King project) in southeastern Utah.

The Uravan Mineral Belt has been an important source of uranium and vanadium in the US for more than 100 years, producing more than 85 million pounds of uranium and over 660 million pounds of vanadium.

Average production grades from the 1940s to January 1979 are reported to be 0.25 per cent uranium and 1.29 per cent vanadium.

All three projects are located within trucking distance of Energy Fuels’ White Mesa mill at Blanding, the only fully licensed and operational uranium and vanadium processing plant in the US.

While Thor has not had contact with the operators of the plant to date, the plant has substantial available capacity for toll treating and may represent a potential low cost entry into production.

Thor’s US uranium and vanadium projects. Pic: Supplied

High-grade uranium and vanadium

The Colorado project claims include historical mines with production activity over more than 100 years. The Utah claims have reported historical drilling with significant intersections of uranium and vanadium.

Both the Wedding Bell and Radium Mountain groups of mines in Colorado are reported to have operated during the first world war and again in the second half of the 20th Century until about 1981 when the price of uranium collapsed.

Meanwhile, the historical drilling at Vanadium King in the early 1980s by Hunt Oil resulted in the definition of a shallow, low-grade non-JORC resource.

Bullish market outlook

Nuclear reactors accounted for 20 per cent of US domestic power requirements and 10 per cent of global power supplies in 2019.

This figure is expected to grow considerably as 53 new reactors are currently under construction globally while another 300 have been proposed.

Taken together, it is no unreasonable to infer that uranium demand is likely to increase over the next 15 years or so.

Additionally, the depressed uranium price has resulted in very few new projects commencing development.

This suggests that a supply shortage may emerge in the next few years, a conclusion that has been brought into sharp focus by the COVID-19 pandemic.

Source: Mining.com

Copyright © 2013 Ferro-Alloys.Com. All Rights Reserved. Without permission, any unit and individual shall not copy or reprint!

- [Editor:wenxin]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think