[Top News]

- Ulanqab issued a document on "double control" of energy consumption of key energy consuming industrial enterprises, which specifies the target and task of "double control" of energy consumption of Ulanqab in the first quarter of 2021: the total monthly electricity consumption of key energy consuming industrial enterprises shall not exceed 3.8 billion kwh, and the key energy consuming industrial enterprises shall reduce 600 million kwh of electricity consumption in January 2021 on the basis of the total electricity consumption of 4.4 billion kwh in December 2020.

- According to Ministry of Industry and Information Technology on January 26, the reduction of steel production is an important measure for China to achieve the goal of carbon peak and carbon neutralization. MIIT will promote the reduction of steel production from four aspects, such as prohibiting new steel production capacity and promoting the merger and reorganization of the steel industry, and will ensure that the steel production will be fully down in 2021.

[Steel Bidding] HBIS Group set its February ferrosilicon bidding price at 7600 yuan per ton, with an increase of 400 yuan per ton month on month but lower than expected, and the volume decreased 1141 tons to 1432 tons.

[Spot Market] The relatively stable market continued to the early stage of January 2021, and the futures market went down from the middle and late January. The new round of steel bidding price of representative steel plants was lower than expected, which affected the bullish sentiment of the market. The spot price also decreased slightly in the last week, but the current cost side was still high, and the spot was still tight, plus the inhibited transportation, the support of steel bidding in February, and the uncertainty of environmental protection power rationing measures in Inner Mongolia, it is expected that the market would be stable in the short term. Pay attention to the change of operation rate and output in the main production areas (the operation rate and output in the main production areas remain at a high level at present), the change of delivery warehouse inventory, the trend of futures market and the implementation of power restriction in the main production areas.

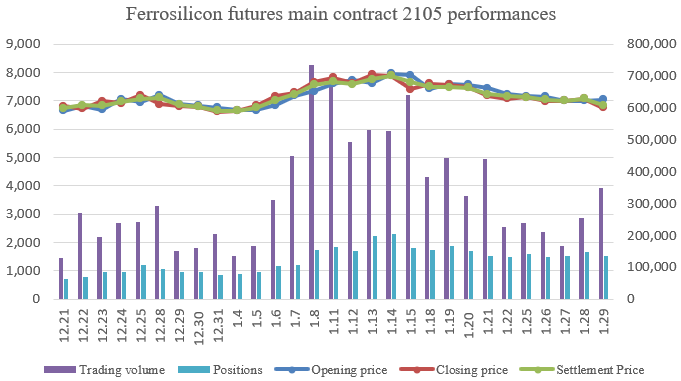

[Ferrosilicon Futures 2105 Contract] Opening price of ferrosilicon futures 2105 contract in January was 6,670, highest price was 7,980, lowest price was 6,572, closing price was 6,752 and the settlement price was 6,850. The trading volumes were 7,727,769 and the positions were 134,943.

[Exports] According to data of China Customs, from January to December 2020, China exported 257205.213 tons of ferrosilicon (containing by weight more than 55% of silicon), a year-on-year decrease of 27.53%; from January to December 2020, China exported 19229.325 tons of ferrosilicon (containing by weight ≤ 55% of silicon), a year-on-year decrease of 39.02%.

[Steel Market] Traditional off-season as well as the approaching of Spring Festival, steel demand weakens and inventory accumulates; steel mills issued winter storage policies, the price is 500 yuan per ton higher than last year, the enthusiasm of traders is not high, and the short-term steel market is expected to be weak. In addition, according to surveys, non-shutdown projects this Spring Festival have been greatly improved compared with last year, and the time for returning to work after the festival may be ahead of schedule, so as to alleviate the situation of sluggish market demand after the festival to a certain extent. However, a large number of people insist on returning home for the new year. The recovery speed after the festival also depends on the arrival of labors and whether the overall starting conditions can be met.

[Magnesium Market] In the early part of this month, under the situation of poor downstream demand, manufacturers had to make a substantial concession to the price for shipments, so the inventory pressure was eased. The magnesium plants began to arrange orders for pre-sale, and the price rose slightly in the middle and late part of this month; in the late January, the coal price fell sharply, and the cost pressure of magnesium plant will also be reduced. Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 14200 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think