[Bidding Information] The steel bidding in April was delayed, and the price gradually dropped: the bidding price of large steel plants in North and South China was both set at 6900 yuan per ton, with a month on month decrease of 600-700 yuan per ton respectively, which frustrated the market confidence of ferrosilicon.

[Spot Market] On the supply side, news about resumption of production of several enterprises in Ningxia region and some enterprises in Inner Mongolia region which has shutdown related furnaces came out; on the demand side, the steel replenishment (steel bidding) has been delayed, and the price has fallen sharply month on month, which made the ferrosilicon market lack of confidence; on the futures side, the market is low, which lacks support for the spot market; on the policy side, although there is a notice of eliminating backward and resolving excess capacity plan in Inner Mongolia region, the fluctuation on the spot market is not big. At present, the accumulation of inventory of ferrosilicon enterprises in the main production areas is gradually obvious, and the market sentiment tends to be depressed. It is expected to continue weak operation in the short term.

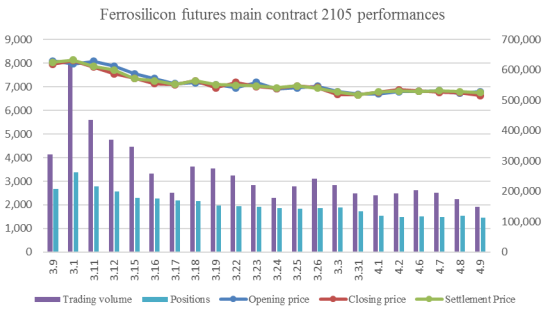

[Ferrosilicon Futures 2105 Contract] Opening price of ferrosilicon futures 2105 contract of this week was 6,812, highest price was 6,946, lowest price was 6,628, closing price was 6,630 and the settlement price was 6,756. The trading volumes were 722,416 and the positions were 112,314.

[Steel Market] With the recovery of macro-economy, the demand for steel has a tough support. This week, the output, consumption and price of steel in domestic market rose slightly, plus Tangshan strict implementation of the production limit emission reduction measures to promote the steel market, there were short-term optimistic expectations.

[Magnesium Market] This week, the domestic magnesium market was stable, raw coal was still high, factory inventory was not much, but downstream demand continued to be cautious, the wait-and-see sentiment was strong, the transaction was slightly flat (export orders were also not much). Current cash quotation including tax of 99.9% magnesium ingots in Fugu area was around 15400-15500 yuan per ton.

- [Editor:kangmingfei]

Save

Save Print

Print Daily News

Daily News Research

Research Magazine

Magazine Company Database

Company Database Customized Database

Customized Database Conferences

Conferences Advertisement

Advertisement Trade

Trade

Tell Us What You Think